The Fastest way to Deposit Your Check

When you use direct deposit, your checks are posted by the opening of business each weekday.

Payments that can be deposited:

- Pay from your employer.

- Social Security, tax returns, retirement benefits, and payments from government agencies.

- Investment income or other payments.

For deposits to or payments from your CHECKING ACCOUNT:

1. Indicate “CHECKING” as the account type

2. Indicate CCU’s 9-digit Routing & Transit Number: 2 2 2 3 8 0 3 5 9

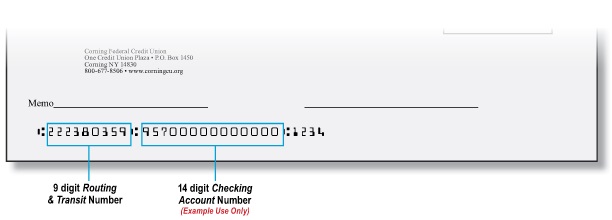

3. Select "Information" from the Tools menu within digital banking OR refer to the bottom of your checks for your 14-digit

Checking Account Number

For deposits to or payments from your SAVINGS ACCOUNT:

1. Indicate “SAVINGS” as the account type

2. Indicate CCU’s 9-digit Routing & Transit Number: 2 2 2 3 8 0 3 5 9

3. Select "Information" from the Tools menu within digital banking OR ask a CCU representative to identify your 10-digit Savings Account Number

Your unique 14-digit Checking Account Number can also be found at the bottom of your checks, as seen in the example image below.

Need Help? Feel free to give us a call.

Payroll Distributions:

- Available to members with direct deposit or payroll deductions.

- Automatically distribute portions of your direct deposit any way you want between your CCU accounts.

- An easy way to save by making budgeted deposits into other accounts, such as your Holiday Club, IRA, or children's savings accounts.

Access Your CCU Tax Documents in Digital Banking

You can access your CCU tax documents within digital banking. As an awareness, these documents are also mailed.

- Log in to Digital Banking

- In your mobile app, select the "More" option, then "Accounts"; on your computer, select "Accounts"

- Select "eDocuments"

- Select "Tax" from the menu

Any available CCU tax documents will be listed here.