Think a Quick Cash Loan is a Quick Fix for Your Financial Woes? Think again!

You may have seen Internet or television ads promoting “quick cash” loans. These are also known as cash advance loans, check advance loans, post-dated check loans, deferred deposit loans, and most commonly, payday loans. Avoid them! They are all short-term

loans that can cause long-term financial issues.

Learn from the Mistakes of Others and Find Better Options!

Many Americans have learned the hard way just how dangerous payday loans can be. Learn from their mistakes. Keep these stories in mind if you ever feel tempted to try a payday loan.

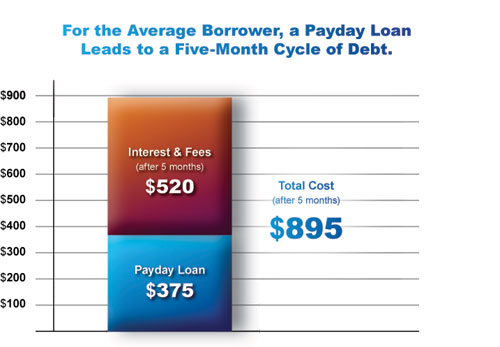

- A February, 2013 article posted by CNNMoney shared some startling statistics about payday loan borrowers. “Nearly

12 million borrowers take out payday loans averaging $375 each, annually. Yet, only 14% can afford to repay the $430 in principal and fees owed after two weeks, according to a Pew Charitable Trusts report based on interviews with more than 700

borrowers. Instead, many borrowers find the $55 fee needed to renew the loan for another two weeks to be much more affordable. For the average borrower that leads to a five-month cycle of debt where they end up owing a total of $520 in fees, plus

the principal on the loan, Pew found in a separate report issued last year.”

- National Public Radio® ran a story in March, 2012, about a man who had “used mortgage money to help provide his family with a nice Christmas. In order to conceal the shortage in mortgage funds, he explained, he took three $500 loans and planned to pay them with his next paycheck. The payday lenders charged a $175 service fee for each of the loans. When the borrower tried to make the

first payment on his loan, he discovered that his check paid down just the service fee for each loan. The loans and fees continued to roll over until he owed much more than he could earn in one paycheck. According to the reporter, the man was

paying 651% interest on the loans which would have cost him $18,000 in one year!”

Here are Some Typical Features of Payday Loans that You Should be Aware of Before You Consider Applying for One.

- Full payment is due by your next pay day.

- Inability to pay brings expensive consequences.

- They usually have a triple digit Annual Percentage Rate (APR).

- Annual percentage rates (APRs) range from 100% to over 1000%.

- Fees ranging from $30 to $120 are charged each time the loan is extended if it is not paid off immediately.

- Finance charges per $100 borrowed range from $15 to $30 or as high as $50.

You should also know that borrowers who cannot afford to repay the loans within two weeks may be forced to roll over the loans and are charged additional interest and fees — repeatedly. The fees and interest are added to the loan total each time it is

rolled over, so that the total amount due increases quickly. Some lenders use different approaches to loan extension to get around state regulations, but it all adds up to the same thing: out-of-control debt that makes the borrower's financial situation

even worse. Unfortunately, millions of Americans are trapped in this downward spiral of payday loan debt. As bad as payday loans sound, they are still legal in some states. The potential for financial gain is so great that many lenders risk making

these loans even where it is not legal. To avoid falling prey to this type of lending, watch out for these catch phrases:

- Quick Cash

- Fast Cash

- Bad Credit OK

- Get Your Money Now

When you are applying for any loan, always read all of the Terms and Conditions. Look for clear statement of the:

- Annual Percentage Rate (APR)

- Loan due date

- Fees charged for application, late fees, add-on fees

- Ability of the provider to pay the loan by multiple payday lenders if borrower cannot pay

Already Experiencing Payday Loan Issues?

If you are one of the many people who currently have payday loan debt, it’s not too late to take control of your finances. First, say “never again” to payday and other fast cash offers, and then

contact CCU. As your credit union, we are here to serve, educate, and assist all of our members; it’s one of the many benefits of membership and an important part of what sets us apart from other financial

institutions. Let us help! Tell us about your situation so that we can connect you with the best resources to allow you to regain your financial footing.

Stay Financially Safe and Sound.

Quick cash and payday loans simply are not the best ways to get through difficult times. More importantly, they pose serious risks to your financial well-being. Internet borrowing from an organization you do not already know and trust can present a risk

to your finances. It can also open the door to fraud and identity theft. Keep your financial situation safe and sound by seeking reasonable lending options.

Talk with a CCU representative to find a path that fits your unique situation, or seek guidance from a trusted family or community member. Choosing one of the following options may

help your financial situation for the long term, not just for right now.

Consider a small loan from CCU or a small loan company.

- Some banks may offer short-term loans for small amounts at competitive rates. A cash advance on a credit card also may be possible, but it may have a higher interest rate than other sources of funds: find out the terms before you decide. In any case,

shop first and compare all available offers.

Shop for the credit offer with the lowest cost.

- Compare the Annual Percentage Rate (APR) and the finance charge, which includes loan fees, interest and other credit costs. You are looking for the lowest APR. Military personnel have special protections against super-high fees or rates, and all consumers

in some states and the District of Columbia have some protections dealing with limits on rates. Even with these protections, payday loans can be expensive, particularly if you roll-over the loan and are responsible for paying additional fees.

Other credit offers may come with lower rates and costs.

Contact CCU, your creditors, or loan servicer as quickly as possible if you are having trouble with your payments.

- Ask for more time. Many may be willing to work with consumers who they believe are acting in good faith. They may offer an extension on your bills; make sure to find out what the charges would be for that service — a late charge, an additional finance

charge, or a higher interest rate.

Contact your local consumer credit counseling service if you need help working out a debt repayment plan with creditors or developing a budget.

- Non-profit groups in every state offer credit guidance to consumers for no or low cost. You may want to check with your employer, CCU, or local housing authority for no- or low-cost credit counseling programs, too.

Make a realistic budget, including your monthly and daily expenditures, and plan, plan, plan.

- Try to avoid unnecessary purchases: the costs of small, everyday items like a cup of coffee add up. At the same time, try to build some savings: small deposits do help. A savings plan, however modest, can help you avoid borrowing for emergencies.

Saving the fee on a $300 payday loan for six months, for example, can help you create a buffer against financial emergencies.

Find out if you have — or are eligible to receive — overdraft protection on your checking account.

- If you are using most or all of the funds in your CCU account regularly and you make a mistake in your account records, overdraft protection can help protect you from further credit problems. It can safeguard your checking account from insufficient

funds by automatically transferring funds from your savings account or Visa® via a cash advance, in the event of an overdraft. Please note that a small fee per transfer or Visa cash advance fee and interest rate may apply.

More Information:

Payday Loans

Additional Payday Loan Examples